Posted by Elena del Valle on March 25, 2013

Dianne Durkin, president, Loyalty Factor

A podcast interview with Dianne Durkin, president, Loyalty Factor is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, she discusses Ten Critical Steps to Achieving Magnetic Leadership with Elena del Valle, host of the HispanicMPR.com podcast.

Dianne is also founder of Loyalty Factor, a consulting and training company. Her background includes finance, direct sales, international marketing and training and development. The author of two books: The Loyalty Factor: Building Employee, Customer and Brand Loyalty and The Power of Magnetic Leadership: It’s Time to get R.E.A.L.

To listen to the interview, scroll down until you see “Podcast” on the right hand side, then select “HMPR Dianne Durkin” click on the play button below or download the MP3 file to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save it to disk. The podcast will remain listed in the March 2013 section of the podcast archive.

Posted by Elena del Valle on March 22, 2013

Raymond Santana, one of The Central Park Five

Video and photos: Florentine Films, Rahoul Ghose

In 1989, a white woman was found raped, beaten, nearly naked and near dead in Central Park in New York City. Weeks later five teenage boys who became known as The Central Park Five, Antron McCray, Kevin Richardson, Raymond Santana, Kharey Wise and Yusef Salaam, were arrested for the crime after they confessed following hours alone with police and aggressive interrogation. In 2002, a judge overturned their convictions based on DNA evidence and a confession from an alleged murderer and serial killer. After their exoneration The Central Park men sued the city, the police and the prosecutors. Scroll down to watch a video clip.

The Central Park Five, a 118-minute documentary released November 2012 and scheduled to air on PBS April 16 and become available online April 17, features the story from the perspective of the young men who were teenagers at the time of the crime. In a slow paced, depressing trip back in time featuring interviews with the men, their relatives and a variety of individuals but excluding anyone from the city, the police or prosecutors who declined to appear in the film or present their point of view, the filmmakers take viewers to 1989 New York City. The film will be available in Spanish on the secondary audio channel.

Filmmaker Ken Burns

Others interviewed include New York City Mayors Ed Koch and David Dinkins; Jim Dwyer, Natalie Byfield and LynNell Hancock, journalists; Reverend Calvin Butts; and Craig Steven Wilder, an historian. The film executives and the film were in the news recently after they won a legal victory against New York City representatives who wanted access to film outtakes for use in their defense in the civil suit the young men brought against the city.

The filmmakers were Ken Burns, David McMahon and Sarah Burns. The film was edited by Michael Levine. The cinematography was by Buddy Squires with Anthony Savini with original music by Doug Wamble. Funding for the film was provided by The Atlantic Philanthropies, Corporation for Public Broadcasting, members of The Better Angels Society, including and Bobby and Polly Stein, and PBS.

Posted by Elena del Valle on March 18, 2013

In the past five years 471 banks have failed in the United States. Their failure has resulted in $95.5 billion in losses and nearly emptied the Federal Deposit Insurance Corporation (FDIC) coffers.

According to a Los Angeles Times article, the FDIC policy has been to settle and keep the information out of the public eye. Relying on the Freedom of Information Act the California newspaper obtained 1,700 pages of FDIC settlements from 2007 to this yea. The settlements with bank insiders were for fraud, negligence, reckless loans, falsified documents, inflated appraisals and lender refusals to purchase back bad loans.

One of the most noteworthy settlements was for $54 million with Deutsche Bank, the world’s largest bank today, over unsound loans that led to a huge bank failure. The bad loans, the article outlines, played a role in the largest payout in history for $13 billion. Because government representatives struck an agreement with the bank with a no press release clause the FDIC was required to remain silent about the terms save in case someone asked specifically about it.

While in past decades the FDIC used to make public punitive actions against banks now the policy is of settle and silence. Since the mortgage crisis the FDIC has settled many agreements in the same way as the Deutsche Bank deal, the article indicates. Such non disclosure agreements are said by some to violate the spirit of the laws that regulate the FDIC.

According to the corporation’s website, “The Federal Deposit Insurance Corporation (FDIC) preserves and promotes public confidence in the U.S. financial system by insuring depositors for at least $250,000 per insured bank; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails.”

Although the FDIC maintains a Problem Bank List with the names of institutions likely to have weak capital positions that could results in failure, fearful of the consequences the Corporation does not publicize the list. An unofficial list with a higher number of banks developed from public sources was published December 7, 2012 by CalculatedRiskBlog.com (http://cr4re.com/PBL12072012.html). The list includes the name of each bank, its FDIC number, assets for the most recent quarter, class, agency it falls under, city, state, date of action, type of enforcement action, reason, corrective action when taken and the date it took place, and the ticker.

According to ProblemBankList.com, as of the end of last year there were 651 problem banks on the FDIC list, reflecting a slight decline from 694 on September 30, 2012; the number of Problem Banks has declined for seven quarters in a row from 888 at March 31, 2011. The website compared the official and unofficial Problem Bank lists concluding there are 805 institutions in the unofficial list compared to 651 on the official FDIC confidential Problem Bank List.

Posted by Elena del Valle on March 15, 2013

How to Say It book cover

Photo: Berkley Publishing Group

In How to Say It: Creating Complete Customer Satisfaction Winning Words, Phrases and Strategies to Build Lasting Relationships in Sales and Service (Prentice Hall Press, $18) Jack Griffin sets out to share practical, results-oriented guidance for effective communication with customers through sample words, phrases, scripts, and strategies applied to real-world examples.

A communications expert and consultant to small businesses, entrepreneurs, cultural institutions, and publishers Griffin has authored other How to Say It titles including How to Say It at Work with estimated sales of 235,000. In this title, published in 2013, he outlines ways to use language to create satisfaction in the customer experience and in the sales-service cycle.

He discusses sales and customer service issues in an integrated way because he believes it reflects today’s business reality and a model that identifies customers as more than individuals to sell to but also as individuals to be satisfied. He thinks that management increasingly expects sales staff to address customer service issues that in the past might have been passed on to the customer service department. At the same time, management expects customer service staff to assist with customer purchases, particularly when it comes to upgrading, upselling, and customer communities promotions.

The 260-page softcover book is divided into 18 chapters and three parts: Speak the Language of Yes, Master the Situation, and Speak the Language of Complete Satisfaction.

The author begins by addressing communication that focuses on the customer, his or her needs and wants, ways to identify new customers, developing customer loyalty, overcoming resistance and using language to close. In Chapter 13, he shares examples of a variety of words for different occasions. In the Words of Credibility section, he recommends readers use words that develop confidence and trust and not get carried away making promises they can’t keep. Examples of such words he lists are guarantee, integrity, commitment, absolute and ethical.

Comments:

Filed Under: Books

Posted by Elena del Valle on March 12, 2013

American Latino Initiative homepage – click to enlarge

Images: American Latino Initiative, Greencard Creative

In 2008, a New York branding agency launched the American Latino Initiative and a related website. Convinced the word Hispanic is outdated, “a static demographic concept and cultural barrier. It is about the past and undercuts the transformative experiences American Latinos go through as they live in America,” the agency set out to change people’s minds about the way they see the growing market segment.

The goals of the initiative’s website are “removing the word Hispanic from the American lexicon; debunking myths and changing the industry narrative about American Latinos; and relentlessly advocating for American Latinos until these consumers are seen first and foremost as culturally diverse U.S. Citizens that value their Latino heritage.” Research for the initiative was funded by Greencard Creative and the clients listed on the website. Greencard Creative has worked with Smirnoff Ice, Pepsico/Ocean Spray, Heineken, Diageo, Petit Nectars, Gallo Winery, Johnson & Johnson, Bayer, Frito Lay, Campbell’s, and the Country of Ecuador.

The Greencard Initiative clients listed in the initiative website conducted research to identify ways their brands fit into their clients lives. Every year, as part of its ongoing research, Greencard Creative funds research for the initiative to supplement client funded research which represents 80 percent of the budget or about approximately $780,000.

Toward the initiative’s goal backers produced a national integrated marketing platform with outreach efforts, lectures, branding campaigns, t-shirts and an art exhibit. Representatives estimate they have reached 1.5 million people nationwide, 135 corporations, non-profits organizations and media companies. Initiative supporters believe they played a role in influencing Univision and the New America Alliance to start utilizing the term American Latino.

Tatiana Pagés, chief executive officer and chief creative officer, Greencard Creative

“It’s not about Hispanics anymore, it’s about American Latinos and the transition to their new identity,” said Tatiana Pagés, chief executive officer and Chief Creative Officer, Greencard Creative. “As a Latino entrepreneur, I feel it is my responsibility to challenge the stereotypes of Hispanics in the U.S. that have been overshadowing who they really are, and limiting where they can go as cultural citizens. Companies and brands have the opportunity to understand American Latinos as hybrid individuals beyond the Hispanic mindset, in order to create effective marketing and advertising campaigns to reach and connect with the fastest growing ethnic segment in our country.”

Based on 380 in home interviews, 72 individual interviews, and 77 group interviews in New York City, Los Angeles, Houston, Austin, Miami, and Chicago conducted with a mix of United States and foreign born Latinos between 2006 and 2012 Greencard Creative representatives concluded Hispanics are hybrid individuals, regardless of the length of time residing in the United States, with an identity that combines their original culture with American traits. They concluded these individuals seek experiences, “even when these experiences contradict the norms of Latino culture.”

Posted by Elena del Valle on March 4, 2013

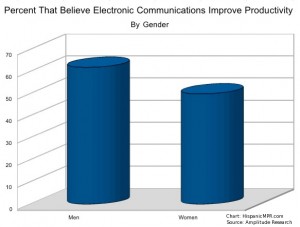

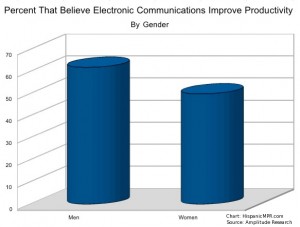

Percent by gender that believe productivity improves with electronic communications

A survey of a nationwide panel of 300 workers who use computers and software as part of their daily job indicates those surveyed regularly communicate in person. Many, 69 percent, respondents said they preferred to share “positive” feedback face-to-face while 63 percent said they prefer to share “negative” feedback that way.

Forty-three percent of respondents said they believed electronic communication improved workplace relationships while only eight percent felt it had a negative impact on relationships. Forty percent of workers said they had worked for an extended period with someone they had never met in person or spoken with on the phone.

Romance via electronic means was seen favorably by some of the respondents. Fourteen percent of survey takers said they flirted with a co-worker by email, texting or instant messaging and 10 percent said they had initiated a workplace romance communicating electronically. When communicating with family from work cell phone calls were the top choice with 36 percent of respondents saying they call family members by cell phone and 20 percent saying they text them.

Men and younger workers were more inclined to consider electronic communication improved productivity. Half of women said they believed electronic communication increased productivity, and 62 percent of men said it increased productivity. Sixty-five percent of respondents 25 to 34 years old said electronic communication increased productivity while 52 percent of those 35 or older said the same.

While few respondents confessed to electronic workplace gossip 44 percent said they liked to gossip in person. When sharing gossip by electronic means 5 percent said they use email; 3 percent said they preferred texting and one percent favored instant messaging. The survey was conducted January 2013 by Amplitude Research on behalf of TrackVia, a Denver based do-it-yourself application builder for business people.

Posted by Elena del Valle on March 1, 2013

Information provided by Event Partner

Horowitz Associates’ 13th Annual Multicutural Media for Multicultural America Forum

March 14, 2013 | Marriott Marquis Hotel, NYC

7:30 a.m. – 4:30 p.m.

Now in its 13th year, this annual Forum is THE venue for learning about trends that affect and influence your viewers and your audiences—America’s multicultural consumers. This year, we will explore “Media’s New Generation”: multicultural, tech-savvy 18-34 year-olds who interact with both traditional and new media in myriad ways, through a host of cutting-edge devices. Our agenda includes a presentation of Horowitz Associates’ latest research on Hispanic multicultural consumers and their media habits, a showcase of the most exciting new multicultural programming, and panels of key industry executives organized around four topics that drive the media industry: the Audience, Content, Technology, and Advertising.

Confirmed speakers include:

Ruben Mendiola, VP and General Manager, Multicultural Video Services, Comcast

Steven Wolfe Pereira, EVP for MediaVest and Managing Director for MediaVest Multicultural

Michelle Webb, Executive Director of Content Acquisition & Programming, Verizon FiOs

Miguel Ferrer, Executive Producer, Digital, Fusion

Lino Garcia, General Manager, ESPN Deportes

Adriana Waterston, VP, Marketing & Business Development, Horowitz Associates, Inc.

The Multicultural Media Forum will take place on Thursday March 14th at the Marriott Marquis in New York City from 7:30 a.m.-4:30 p.m. Visit www.multiculturalmediaforum.com for more information and to register. Enter promotional code HMPR2013 and receive an extra $50 off!

For more information and sponsorship opportunities, please contact us at 914-834-5999 or kirstynn@horowitzassociates.com.

Posted by Elena del Valle on March 1, 2013

Bailout book cover

Photos: Free Press

Neil Barofsky was assistant U.S. Attorney for the Southern District of New York when he was called to serve his country. From December 2008 to March 2011 he was special inspector general in charge of oversight of the Troubled Asset Relief Program (TARP) under the Bush and Obama administrations. It was his job to oversee the program against fraud and abuse in the spending of $700 billion allocated to the national bank rescue.

In Bailout How Washington Abandoned Main Street While Rescuing Wall Street (Free Press, $16), a bestseller he spent 27 months living and four months writing, he describes his experience and explains why he became disillusioned with the system and the mishandling of billions in public money by representatives of both political parties. The paperback edition was published last month with a new Foreword in which he outlines a number of banking scandals that have come to light following the original publication of the book. He mentions the London InterBank Offered Rate (LIBOR), the accusations that HSBC was involved in transactions with terrorist and narcotics, the accusations that Wells Fargo and Bank of America defrauded the government, and scandals in which JPMorgan Chase, Deutsche Bank, and Credit Suisse were named.

Neil Barofsky, author, Bailout

The 272-page book is divided into twelve chapters: Fraud 101; Hank Wants to Make It Work; The Lapdog, the Watchdog and the Junkyard Dog; I Won’t Lie for You; Drinking the Wall Street Kool-Aid; The Worst Thing That Happens, We Go Back; By Wall Street for Wall Street; Foaming the Runway; the Audacity of Math; The Essential $7,700 Kitchen Assistant; Treasury’s Backseat Driver; and Happy Endings.

In the book, Barofsky discusses the debacle that resulted in only $1.4 billion out of $50 billion in bailout money designated to rescue homeowners reaching intended people; how the interests of powerful people and companies ultimately won repeatedly over the interests of taxpayers; the fraud, obstruction, deceit and immoral spending of public monies to favor Washington and Wall Street parties; the government’s unwillingness to reign in the offenders and hold them accountable; and the criminal justice system’s inability to address the problems that plague the system.

The author, now senior fellow at New York University School of Law, explains in the Afterword that his anger at the injustices in the system drove him to write the book. He goes on to say that Americans should lose faith in their government, deplore the politicians and regulators that allowed taxpayer dollars to go to the banks with no accounting for how they were spent, and be revolted by a financial system that rewards failure and protects the fortunes of the wrongdoers. He hopes that the rage of Americans drives reform and rips the system away from the “corrupting grasp of the megabanks.”

Comments:

Filed Under: Books