Posted by Elena del Valle on August 31, 2011

Mercadito Midtown

Photos: TransMedia Group, Mercadito Midtown

Earlier this month, Rock Hard Taco, a Mexican cuisine restaurant with a So-Cal style atmosphere, opened in Boca Raton, Florida (scroll down for the Rock Hard Taco Mahi Mahi Tacos recipe courtesy of Rock Hard Taco). Not too far south in Miami Mercadito Midtown serves creative Mexican cuisine, especially tacos.

The Mercadito restaurant and its sister properties specializing in Latin American cuisine are owned and operated by Mercadito Hospitality, a company that has grown from a first New York City location in 2004 to four restaurants. The company, owned by Alfredo Sandoval, Felipe Sandoval and Patricio Sandoval, has a second restaurant in New York and one Chicago.

A dish at Rock Hard Taco

What down economy? You wouldn’t know there is a stagnant economy in the country by watching this company’s growth. Mercadito Hospitality, which also owns and operates Double A, an exclusive cocktail lounge next to Mercadito in Chicago, plans to open Tavernita, a second Chicago restaurant, this summer and a second one in Miami this fall. Company executives believe their success can be attributed to the innovative interpretations of traditional Mexican cooking of Chef Patricio Sandoval, and the complex flavored beverages on offer.

At the same time that ethnic food restaurants gain popularity nationwide (see Hispanic, Asian foods booming ) the popular food truck movement in urban areas and television cooking programs nationwide may be the continuing catalyst for at home trial of ethnic foods. It seems there is room for growth in varied ethnic food types, according to Ethnic Foods U.S. January 2011, a Mintel (a research company) survey released earlier this year.

Carnitos Tacos at Mercadito Midtown

The more consumers are exposed to foreign cultures and cuisines the more likely they may be to try preparing some of those dishes at home, especially this year when many families are eating at home frequently due to increases in unemployment and related issues. Mintel analysts believe consumers preparing ethnic foods at home are more likely to be of a nationality or heritage different than that of the food type they are preparing.

For example, although less than 65 percent of the population is Italian 65 percent of survey responders said that they prepared at least one Italian meal at home in the past month. Similar percentages were evidenced for other ethnic foods: Mexican (60 percent), Chinese (42 percent), Spanish/Tapas (17 percent), Japanese (16 percent), Greek (12 percent), Indian (13 percent ), Thai (12 percent), and Korean (8 percent).

Rock Hard Taco Mahi Mahi Tacos

Posted by Elena del Valle on June 17, 2013

Homemade hummus, a spread made with mashed chickpeas, oil, garlic, and lemon juice

Photo: HispanicMPR

Americans like ethnic foods. That market segment is estimated at $8.7 billion for last year. Young adults and families with children like to prepare ethnic foods at home. Nine of ten adults 25 to 34 years of age in the United States who took a Mintel survey said they prepared ethnic food at home the previous month.

Among older adults 65 and older who took the survey 68 percent responded positively to the same question. Most people with children at home, 91 percent, said yes to the question compared to 78 percent among people with no children.

Mintel analysis in Ethnic Foods US January 2013 indicates the 12 percent growth in ethnic food sales between 2007 and 2009 was due to people eating in restaurants less often and dining at home more often to save money. While growth of ethnic food slowed to 4.5 percent from 2010 to 2012, according to Mintel that market segment is forecast to grow 20 percent between 2012 and 2017.

Hispanic food among survey takers was the most popular. More than half, 58 percent, said they prepared Hispanic food within the last month versus 55 percent who indicated they made Italian dishes and 44 percent who chose Asian food.

“The popularity of Hispanic food is likely due to how mainstream it has become in the US and the ease and convenience of preparing it,” said John N. Frank, category manager, CPG food and drink, Mintel, in a press release. “The endless supply of Mexican, Cuban and other Hispanic-based restaurants have given home cooks infinite possibilities for re-creating these restaurant-style meals at home.”

The largest (in terms of sales) of the ethnic food market’s five segments, per Mintel data, is Mexican/Hispanic although the growth for that type of food was negligible from 2010 to 2012. The next segment, while much smaller, corresponds to Asian food which had a 10.2 percent dollar sales increase and a 1 percentage point market share growth in the same time period.

Mediterranean/Middle Eastern foods, the third largest segment while much smaller than the other two, grew the most in those two years and is forecast to grow the most in dollar sales between 2012 and 2017. The ethnic food category, Mintel research indicates, responds to price and deals. Survey respondents exhibited low brand loyalty.

Authenticity is the top ethnic food characteristic, according to a July 2012 article (Research Spotlight: Ethnic Foods: Flying High) in SpecialtyFood.com. The article suggests that food manufacturers and marketers would increase consumer interest in their products, women and seniors in particular, by providing and promoting products with health benefits which interest both segments.

Posted by Elena del Valle on February 27, 2009

Who’s Buying by Race and Hispanic Origin (New Strategist, $59.95) is part of the Who’s Buying series and features 123 pages of spending information about Asian, black and Hispanic consumers in 2005. The paperback book is divided into 12 sections and four appendices.

Following a Household Spending Trends discussion for 2000 to 2005, there is an overview followed by information on spending apparel, entertainment, financial products and services, food and alcoholic beverages, gifts, healthcare, housing, and transportation shelter and utilities. There is also a section on personal care, reading, education and tobacco. The appendices address the Consumer Expenditure Survey, Mortgage Principal and Capital Improvements and Spending by Product and Service Ranked by Amount Spent.

New Strategist is a New York publishing company. Other titles published by the company include Household Spending, Who’s Buying for Travel, Who’s Buying Apparel, Who’s Buying Health Care, Who’s Buying Household Furnishings, Services and Supplies, Who’s Buying for Pets, Who’s Buying by Race and Hispanic Origin, Who’s Buying at Restaurants and Carry-Outs, Who’s Buying Transportation, Who’s Buying Groceries, Who’s Buying Entertainment, Who’s Buying by Age and Who We are Hispanic.

Click here to buy Who’s Buying by Race and Hispanic Origin

Comments:

Filed Under: Books

Posted by Elena del Valle on July 11, 2011

P.F. Chang’s at Sawgrass Mall in South Florida, one of many Asian restaurants across the country

Photo: HispanicMPR

Do you feel like having some Mexican food for dinner tonight? How about something Asian or Indian, Creole, Mediterranean or Middle Eastern? If you said yes, you are among a growing number of Americans opting for ethnic meals. In the past five years growth, after inflation, of ethnic foods increased 6 percent. In 2010, ethnic food sales were $2.4 billion. This growth is considered by some researchers healthy for that time period, especially in comparison with other food types.

In addition, sales of ethnic foods may increase 10 percent (or 19 percent without taking inflation into account) in the next five, according to Ethnic Foods U.S. January 2011, a report by Mintel, a research company. Mintel researchers and analysts believe the increase is due to a combination of a diverse population in the United States, a resurgence of home cooking resulting from the recession, bubbling interest in international foods prompted by travel and cooking shows, and increases in ethnic menu items.

Although Mexican/Hispanic food products continue to be the largest segment of the ethnic foods market, accounting for 62 percent of food, drug and mass market sales, this segment only exhibited a 1 percent growth in 2009-10. The second largest ethnic market, accounting for 29 percent of sales, is Asian foods. This segment grew the most between 2009 and 2010, almost 5 percent. In the last five years (2005 to 2010), this market segment increased by 39 percent compared to the rest of the market which grew a modest 13 percent in comparison.

The growth of chain restaurants serving ethnic foods across the United States seems to reflect these trends. For example, late last year there were credible reports that Panda Express, a fast food restaurant chain, planned a 70 percent growth over the next five years, from 1,350 to 2,300. Chipotle, the booming Latino organic fast food chain, also announced plans to open an Asian restaurant similar to the Chipotle model for the second half of 2011. P.F. Chang’s China Bistro owns and manages 200 Chinese American cuisine restaurants nationwide, according to the company website.

Posted by Elena del Valle on April 16, 2010

Best Customers: Demographics of Consumer Demand

Did you know that on average Asian households in America spend more than non Hispanic white households? And that black and Hispanic households spend less? At the same time, there are wide variations in some spending habits by ethnic groups. For example, Asian households spend very little on pets while blacks and Hispanics spend significantly more than other groups for children’s clothes.

Marketers wanting to prepare for trends such as the Baby Boomer generation and the rise of ethnic emerging markets like the Asian, black and Hispanic segments, which are estimated to account for one of every five dollars of purchases in America, may be interested in the detailed information about the products and services consumers bought in past years outlined in Best Customers: Demographics of Consumer Demand (New Strategist Publications, $89.95).

The 775-page softcover book breaks down purchases and spending patterns by the demographic characteristics of households based on data from the Bureau of Labor Statistics’ 2007 Consumer Expenditure Survey. The source of the previously unpublished data is surveys of household spending. The time lag between the data collection and the publication of the book, 2009, is about two years.

The book is divided into 21 chapters (in alphabetical order): Alcohol, Apparel, Computers, Education, Entertainment, Financial Products and Services, Furnishings and Equipment, Gifts for People in Other Households, Groceries, Health Care, Reading Material, Restaurants and Carry-Outs, Shelter, Telephone, Tobacco Products, Transportation, Travel and Utilities; and four appendices: About the Consumer Expenditure Survey; Percent Reporting Expenditure and Amount Spent, Average Quarter 2007; Spending by Product and Service, Ranked by Amount Spent, 2007; and Annual Average Household Spending, 2000 and 2007.

The information in the book was originally gathered by the Census Bureau to allow the federal government to track prices. Two groups of 7,000 households (technically called consumer units) each in 91 areas of the country provide the data through two different surveys which are thought to cover 95 percent of expenditures. It is not clear if undocumented residents are included in the survey. Other sources of similar data collection indicate the Consumer Report Survey data is lower than actual except for: rent, fuel, telephone service, furniture, transportation and personal care services.

New Strategist Publications publishes other demographic data titles about consumers (see Book outlines spending by race, ethnic group and New York publisher shares household spending summary) and Hispanics (see Data rich book outlines Hispanic market profile).

Click here to buy Best Customers

Comments:

Filed Under: Books

Posted by Elena del Valle on August 17, 2009

TheLatinProducts.com homepage - click to enlarge

Photos: TheLatinProducts.com

For homesick Latinos Georgia based TheLatinProducts.com website offers a little relief. Among its 1,800 product offerings the online supplier sells ethnic foods, cleaning products and spices some of which remind customers of their home country or the country of their heritage. Buyers are regular consumers, chefs, Latin restaurants, and small to medium size Latino grocery stores. The portal sells 300 Hispanic market oriented products from Mexico, Guatemala, Colombia, United States and Venezuela.

TheLatinProducts.com was founded in Acworth, Georgia by Francisco Tovar, a Venezuelan who immigrated to the United States in 1997. The average customer is between 25 and 45 years of age and earns $40,000 a year or more. Sixty-five percent of the customers are women. One quarter of buyers are on the West Coast, 40 percent on the East Coast; 15 percent in the South and the remainder, 20 percent, in the central and mountain areas. What are the three most popular products? Maseca, Goya products and spicy sauces. Well known product lines available on the portal are La Costena, Jumex, Nestle, D’Gari, Maseca, La Preferida, Dona Maria and Gamesa.

Francisco Tovar, owner, TheLatinProducts.com

“TheLatinProducts.com provides the lowest price guaranteed online of Mexican food and Latin food. This exceptional concept is available at one user online friendly location, offering secure shopping, complemented by rapid and reliable delivery services directly to any home, office, business or military base,” said Tovar by email when asked about his business.

He promotes TheLatinProducts.com on major search engines and with public relations strategies. From August to September 4 the portal will be offering 10 percent off all of its item for customers who use Coupon Code augsep409.

Tovar came to the United States to study in 1997 and graduated in 2002 with a Bachelor of Science in Information Systems, Cum Laude, from Mercer University in Atlanta, Georgia. Prior to launching the portal he worked in real estate.

He dedicated a year to conducting research looking at major brands, distributors, terms and conditions before relying on his technical background to establish Tovar Investments LLC, the company that owns the portal. This year, he opened the online store which has more than 200 customers including restaurants and Latin stores throughout the United States and a few clients in Europe. He figures the main reason his customers shop at the virtual store is to save time and money.

Reach Hispanics online today with

“Marketing to Hispanics Online” audio recording

Identifying and characterizing the booming Hispanic online market

Joel Bary, Alex Carvallo and Matias Perel

Find out about

• The 16 million Latino online users

• Latino online users by gender

• What they do online

• Their language preferences

• How to reach Hispanic urban youth online

• What affects their online behavior

• What influences their purchases

Click here for information about “Marketing to Hispanics Online”

Posted by Elena del Valle on February 6, 2009

The 130-page Who’s Buying Executive Summary of Household Spending Third Edition (New Strategist, $59.95) features concise data on buying across the country for 2005. The paperback book includes information on consumer spending patterns by age, race and ethnicity, household type, and region.

The source of the information is the Consumer Expenditure Survey of the Bureau of Labor Statistics, a national survey of household spending. There are indexed spending figures illustrating what households spend on many products and services, and whether the households expenditures in a segment are higher or lower than the average for all households in that segment and by how much. The indexed spending tables, based on the average figures, were produced by the publisher’s staff.

The book lists data for 2005 as follows: Spending by Age, Spending by Income, Spending by High-Income Consumer Units, Spending by Age and Income, Spending by Household Type, Spending by Household Type and Age, Spending by Region, Spending by Region and Income, Spending by Metropolitan Area, Spending by Race and Hispanic Origin, Spending by Education, Spending by Household Size, Spending by Homeowners and Renters, Spending by Number of Earners, and Spending by Occupation.

New Strategist is a New York publishing company. Other titles published by the company include Household Spending, Who’s Buying for Travel, Who’s Buying Apparel, Who’s Buying Health Care, Who’s Buying Household Furnishings, Services and Supplies, Who’s Buying for Pets, Who’s Buying by Race and Hispanic Origin, Who’s Buying at Restaurants and Carry-Outs, Who’s Buying Transportation, Who’s Buying Groceries, Who’s Buying Entertainment, Who’s Buying by Age and Who We are Hispanic.

Click here to buy Who’s Buying Executive Summary of Household Spending

Posted by Elena del Valle on June 10, 2008

Dining out preferences by ethnic group – click on image to enlarge

Photos: Mintel, Pizza Patron

According to a recent study, people are dining out less often because of economic hardships. At the same time, the study indicates growth in restaurants in the coming years will be the result of patronage from Echo Boomers (children of Baby Boomers) and Hispanic and Asian immigrants.

Studies indicate ethnic restaurant goers are more likely to seek exotic flavors. This is significant because some researchers believe the Echo Boom generation, many of which are immigrants or children of immigrants, will show the greatest increase in percentage of the overall population between 2002 and 2012.

A November 2007 study by the National Restaurant Association, indicates restaurant activity has fallen to its lowest level since February 2003 because customers are dining out less frequently. It is also noteworthy that 51 percent of restaurants surveyed expect economic conditions to worsen in the coming months. Mintel research from January 2008 indicates that 54 percent of people who dine out regularly are cutting back on restaurant spending because of the economy.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

-

Find out what makes 25 percent of the top 500 Hispanic market advertisers out perform the remaining companies

-

Discover what questions to ask, steps to take to be a Best in Class company

Click here for more about “Best in Class Hispanic Strategies” audio recording

Many Americans are eating out less often blaming their decision on the skyrocketing price of fuel and increases in many consumer goods including food, as well as the boom in home foreclosures and the recession. Seventy percent of consumers who responded to the Mintel survey are attempting to save on meals by going out to eat fewer times a month instead of choosing cheaper entrees or dining at less expensive restaurants.

David Morris, senior analyst, Mintel

“People aren’t trading down for cheaper or lower quality food; they’re just trading out,” said David Morris, senior analyst at Mintel. “Especially when you consider the price of casual and fine dining, staying in can reduce costs significantly.”

Hispanics many not be surprised to discover that few Latino oriented selections were found among the national trends identified by Mintel researchers. The company’s executive summary indicates that “Although efforts to target the Hispanic community are notable, there is a lack of Hispanic taste-inspired menu items that would likely be a popular addition.”

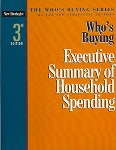

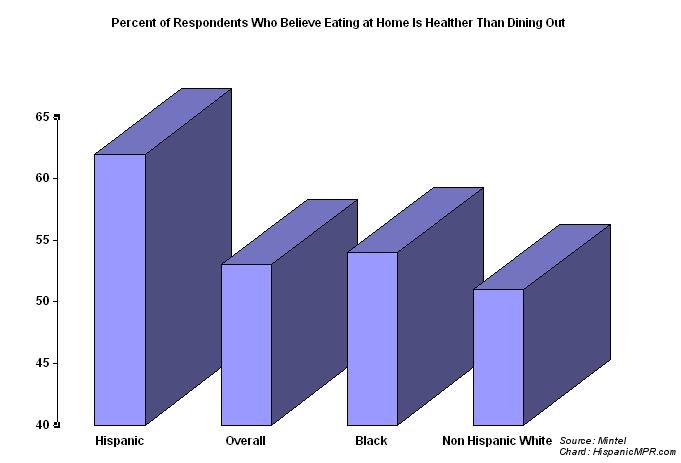

A Pizza Patron restaurant

In general, adults 18 to 24 years old are the group most likely to say that they are spending more. Older adults, aged 45 to 54 are those most likely to cut back on spending. Hispanics respondents were the most likely to believe at home meals are healthiest. Sixty-two percent of Latino respondents believed “I could eat healthier if I ate at home instead of going to a restaurant;” compared to consumers overall (53 percent), white (51 percent) and black (54 percent) respondents.

The Mintel survey was weighted against the U.S. population to make it representative of the varied demographic groups For the purposes of this report, Mintel commissioned exclusive consumer research through Greenfield Online to explore consumer attitudes towards dining out. Researchers conducted fieldwork in January 2008 among a nationally representative sample of 2,000 adults aged 18 and older.

Mintel also analyzed data from Simmons Research, using the National Consumer Survey (NCS) which was conducted between May 2006 and June 2007. The results presented in the Mintel study are based on a sample of 25,375 adults 18 and older with results weighted to represent the U.S. population.

Founded in 1919, the National Restaurant Association is a restaurant industry business association. Mintel, founded in the United Kingdom 35 years ago, is a supplier of consumer, media and market research. The company, with offices in Chicago, London, Belfast, Sydney and Shanghai, has been studying the United States Hispanic market since 2003.

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here for information on the Hispanic Marketing & Public Relations books

Posted by Elena del Valle on February 2, 2006

Reported by Hispanic Business Magazine:

The 2005 top 25 Hispanic advertising agencies in the United States.

For agencies reporting their earnings, here are the top 25 ranked by gross reported billings, in ($) millions.

- Tapestry, The Multicultural Division of

Starcom MediaVest Group

Chicago, IL

(312) 220-6262

Ownership: Starcom MediaVest Group

Year founded: 1987

No. of employees: 60

2005 gross billings: $382.0 million

2004 gross billings: $364.0 million

CEO: Monica M. Gadsby

Clients: Coca-Cola, Disney, Kraft, Masterfoods, Miller, P&G

- Zubi Advertising Services

Coral Gables, FL

(305) 448-9824

Ownership: Independent/100% Hispanic-owned

Year founded: 1979

No. of employees: 112

2005 gross billings: $170.0 million

2004 gross billings: $160.0 million

CEO: Teresa A. Zubizarreta

Clients: American Airlines, Florida Lottery, Ford Motor Co., GenWorth, MasterFoods (M&M, Mars), Olive Garden Restaurants, J.M. Smuckers Co., S.C. Johnson, Wachovia, Winn Dixie

- Lopez Negrete Communications

Houston, TX

(713) 877-8777

Ownership: Independent/51%

Hispanic-owned

Year founded: 1985

No. of employees: 115

2005 gross billings: $135.0 million

2004 gross billings: $110.0 million

CEO: Alex Lopez Negrete

Clients: Wal-Mart Stores, Bank of America, Tyson Foods, Visa USA, Azteca Milling, Reliant Energy, MicroSoft, Shell Oil

- The Cartel Group

San Antonio, TX

(210) 696-1099

Ownership: Independent/100%

Hispanic-owned

Year founded: 1990

No. of employees: 65

2005 gross billings: $92.0 million

2004 gross billings: $87.0 million

CEO: Victoria V. Negrete

Clients: U.S. Army, Church’s Chicken, Dr. Pepper

- Arvizu Advertising & Promotions

Phoenix, AZ

(602) 279-4669

Ownership: Independent/100%

Hispanic-owned

Year founded: 1991

No. of employees: 63

2005 gross billings: $84.0 million

2004 gross billings: $69.5 million

CEO: Ray Arvizu

Clients: Bashas/FoodCity, Qwest Communications, MasterCard, McDonald’s

- la comunidad

Miami Beach, FL

(305) 865-9600

Ownership: Independent/100%

Hispanic-owned

Year founded: 2000

No. of employees: 55

2005 gross billings: $80.0 million

2004 gross billings: $75.0 million

CEO: Jose Molla

Clients: Citibank, Best Buy, Volkswagon Argentina, Subway, Virgin Mobile, Perry Ellis, Disney Channel, Red Bull (Argentina), Rolling Stone, MTV/VH1

- Castells & Asociados Advertising

Los Angeles, CA

(213) 688-7250

Ownership: Independent/30%

Hispanic-owned

Year founded: 1998

No. of employees: 50

2005 gross billings: $57.0 million

2004 gross billings: $55.0 million

CEO: Liz Castells

Clients: Safeway/Vons/Dominick’s, HealthNet, McDonald’s, Toyota, Time Warner Cable, Las Vegas CVA, GMAC Mortgage

- The San Jose Group

Chicago, IL

(312) 565-7000

Ownership: Independent/100%

Hispanic-owned

Year founded: 1981

No. of employees: 53

2005 gross billings: $50.5 million

2004 gross billings: $43.8 million

CEO: George L. San Jose

Clients: American Trans Air, National Pork Board, Grupo Herdez/Hormel, Hormel Foods, Glaxosmithkline, Exelon

- LatinWorks

Austin, TX

(512) 479-6200

Ownership: Independent/100%

Hispanic-owned

Year founded: 1998

No. of employees: 40

2005 gross billings: $46.0 million

2004 gross billings: $42.4 million

CEO: Manny Flores

Clients: Anheuser-Busch, U.S. Cellular, ConAgra, ESPN Deportes, NetSpend, The Gillette Company

- Acento Advertising

Los Angeles, CA

(310) 943-8300

Ownership: Independent/100%

Hispanic-owned

Year founded: 1983

No. of employees: 35

2005 gross billings: $45.0 million

2004 gross billings: $40.0 million

CEO: Benito Martinez-Creel

Clients: Albertson’s, Sav-On, Staples, Cacirve, Conoco Phillips, Epson, CSK Auto

- La Gente de RLR

Pasadena, CA

(626) 440-0321

Ownership: Independent/95%

Hispanic-owned

Year founded: 1989

No. of employees: 29

2005 gross billings: $42.0 million

2004 gross billings: $39.0 million

Principal: Ralph Lacher

Clients: Verizon Wireless, AAA, Talon Group, Michels & Watkins, Wescom Credit Union, Los Angeles Zoo, Sit N’ Sleep, Westcorp, Liverpool

- Creative Civilization – An Aguilar/Girard Agency

San Antonio, TX

(210) 227-1999

Ownership: Independent/100%

Hispanic-owned

Year founded: 1999

No. of employees: 34

2005 gross billings: $35.7 million

2004 gross billings: $31.5 million

CEO: Al Aguilar

Clients: Hearst Corp. Express-News, Conexion, American Cancer Society, San Antonio Spurs, City Reach Latino, CPS Energy, University Health Systems, Kaiser Family Foundation, Toyota Motor Manufacturing-Texas

- Viva Partnership

Miami, FL

(305) 576-6007

Ownership: Independent/100%

Hispanic-owned

Year founded: 1997

No. of employees: 25

2005 gross billings: $32.0 million

2004 gross billings: $32.0 million

CEO: Linda Lane Gonzalez

Clients: Verizon Wireless, Bealls, BJ’s

- Ole

New York, NY

(212) 465-3222

Ownership: Independent/100%

Hispanic-owned

Year founded: 2003

No. of employees: N/A

2005 gross billings: $30.0 million

2004 gross billings: $23.0 million

CEO: Javier Escobedo

Clients: Target Stores, HSBC Credit Centers, La Cochita Mexican Foods, GE Consumer Finance, AHAA/Advertising Age

- Euro RSCG Latino

New York, NY

(212) 886-4100

Ownership: Euro RSCG Worldwide

Year founded: 1997

No. of employees: 20

2005 gross billings: $30.0 million

2004 gross billings: N/A

CEO: Eliud Kauffman

Clients: PUIG Beauty & Fashion Group, Volvo Cars North America, MCI

- Headquarters Advertising

San Francisco, CA

(415) 626-6200

Ownership: Independent/100% Hispanic-owned

Year founded: 1987

No. of employees: 25

2005 gross billings: $25.0 million

2004 gross billings: $22.0 million

CEO: Horacio Gomes

Clients: AAA, Pacific Gas & Electric Company, Monterey Bay Aquarium, United Health Group

- Anita Santiago Advertising

Santa Monica, CA

(310) 396-8846

Ownership: Independent/100%

Hispanic-owned

Year founded: 1987

No. of employees: 27

2005 gross billings: $24.0 million

2004 gross billings: $26.5 million

CEO: Anita Santiago

Clients: Wells Fargo, IKEA North America, Sees Candies

- CreativeOndemanD

Coral Gables, FL

(305) 529-6464

Ownership: Independent/100%

Hispanic-owned

Year founded: 1998

No. of employees: 23

2005 gross billings: $24.0 million

2004 gross billings: $22.0 million

CEO: Daniel Marrero/Priscilla Cortizas

Clients: Volkswagen of America, Volkswagen Latin America, Burger King International, Regions Bank, May Stores, Cartoon Network

- Hill Holliday Hispanic

Miami Beach, FL

(305) 604-3005

Ownership: IPG

Year founded: 2003

No. of employees: 18

2005 gross billings: $17.0 million

2004 gross billings: $10.0 million

CEO: Jose Lopez-Varela

Clients: CVS/pharmacy, Dunkin’ Donuts, LoJack, Sallie Mae, Uniroyal

- MASS Hispanic Marketing

Miami, FL

(305) 351-3600

Ownership: Independent/100%

Hispanic-owned

Year founded: 1986

No. of employees: 20

2005 gross billings: $13.0 million

2004 gross billings: $13.0 million

CEO: Alicia Martinez-Fonts

Clients: Kimberly-Clark, Unilever

- Interlex

San Antonio, TX

(210) 930-3339

Ownership: Independent/100%

Hispanic-owned

Year founded: 1995

No. of employees: 10

2005 gross billings: $12.5 million

2004 gross billings: $5.0 million

CEO: Rudy Ruiz

Clients: Texas Department of State Health Services, U.S. Department of Homeland Security, American Cancer Society

- HispanicWorks

New York, NY

(212) 252-8800

Ownership: A division of GlobalWorks/

5% Hispanic-owned

Year founded: 2002

No. of employees: 15

2005 gross billings: $12.0 million

2004 gross billings: $9.0 million

CEO: William Ortiz

Clients: Cablevision, Citizens/CharterOne Bank, Verizon Wireless, Ortho Evra

- Español Marketing & Communications Inc.

Cary, NC

(919) 678-6133

Ownership: Independent/0%

Hispanic-owned

Year founded: 1994

No. of employees: 10

2005 gross billings: $10.7 million

2004 gross billings: $10.1 million

CEO: Eva A. May

Clients: Corona Extra, Modelo Especial, Countrywide Financial, Jaritos (Nova Mex)

- Ethnic Marketing Group

Valencia, CA

(661) 295-5704

Ownership: Independent/100%

Hispanic-owned

Year founded: 1991

No. of employees: 15

2005 gross billings: $10.5 million

2004 gross billings: $8.05 million

CEO: Enrique Gil

Clients: Weber Grills, DeWalt Tools, Kern’s Nectars, Conagra Foods, NASCAR

- LatinSphere Advertising

Long Beach, CA

(562) 983-5103

Ownership: Independent/100%

Hispanic-owned

Year founded: 2001

No. of employees: 24

2005 gross billings: $7.4 million

2004 gross billings: N/A

CEO: Karl Lucia and Cristi Quesada-Costa

Clients: Verizon, Sears, Walt Disney Company, Disneyland, OSH, Baby Einstein, MAD, ABC

Top Hispanic Advertising Agencies Not Reporting Revenues in 2005

In alphabetical order, with last reported year’s gross billings, in ($) millions, and new clients

Accentmarketing

Coral Gables, FL

(305) 461-1112

Ownership: Interpublic Group

of Companies

Year founded: 1986

Last information published (2003):

2003 no. of employees: 92

2003 gross billings: $99 million

CEO: Steve Blanco

New clients since 2003:

Buick, On Star, Kaiser Permanente, Grainger, GMAC Financial Services

The Bravo Group

New York, NY

(212) 780-5800

Ownership: WPP

Year founded: 1980

Last information published (2002):

2002 no. of employees: 220

2002 gross billings: $270 million

CEO: Gary Bassell

New clients since 2002:

Hertz, Paramount Great America, Jaguar, Land Rover, Lifetime Television, Miller Brewing Company, Novartis, Road Runner, Toys R Us, Visa

Bromley Communications (1)

San Antonio, TX

(210) 244-2000

Ownership: Publicis

Year founded: 1981

Last information published (2002):

2002 no. of employees: 120

2002 gross billings: $184 million

CEO: Ernest Bromley

New clients since 2002:

BMW, Coors Brewing Company, ESPN.com

Casanova Pendrill Inc.

Costa Mesa, CA

(714) 918-8200

Ownership: IPG

Year founded: 1984

Last information published (2004):

2004 no. of employees: 71

2004 gross billings: $160 million

CEO: Dan Nance

New clients since 2004:

Brown Forman, Xbox

Dieste Harmel & Partners

Dallas, TX

(214) 800-3500

Ownership: Omnicom

Year founded: 1995

Last information published (2004):

2004 no. of employees: 188

2004 gross billings: $205 million

CEO: Tony Dieste

New clients since 2004:

Dallas Cowboys

Lapíz Integrated Hispanic Marketing

Chicago, IL

(312) 220-5000

Ownership: Publicis Groupe

Year founded: 1987

Last information published (2003):

2003 no. of employees: 66

2003 gross billings: $180 million

CEO: Dolores Kunda

New clients since 2003:

Bank One, Kellogg’s Snacks (Keebler), GM Goodwrench

MendozaDillon

Irvine, CA

(949) 754-2000

Ownership: WPP Group PLC

Year founded: 1979

Last information published (2002):

2002 no. of employees: 60

2002 gross billings: $89 million

CEO: Ingrid Otero-Smart

New clients since 2002:

Good Humor/Breyers, Irvine Barclay Theater, Ragu, Tomas Rivera Policy Institute, Joss Claude, Cingular Wireless, HSBC, Listerine

SiboneyUSA

Miami, FL

(305) 373-2526

Ownership: Interpublic Group of Companies

Year founded: 1983

Last information published (2003):

2003 no. of employees: 40

2003 gross billings: $50 million

CEO: José M. Cubas

New clients since 2003:

DexMedia, Blue Cross Blue Shield of Florida, Medimune, MiZona Hispana

The Vidal Partnership

New York, NY

(212) 867-5185

Ownership: Independent/100% minority-owned

Year founded: 1991

Last information published (2004):

2004 no. of employees: 125

2004 gross billings: $160 million

CEO: Manny Vidal

New clients since 2004:

Nissan

Winglatino

New York, NY

(212) 500-9400

Ownership: Grey Global Group

Year founded: 1979

Last information published (2004):

2004 no. of employees: 40

2004 gross billings: $53 million

CEO: Jackie Bird

New clients since 2004:

Liberty Mutual, McNeil Consumer, Smirnoff Ice

Hispanic Advertising Agencies Resource List

(1) Bromley Communications acquired Publicis Sanchez & Levitan, LLC, which reported gross billings of $92.0 million in 2003.

Source: Data compiled by HispanTelligence®

Source:Hispanic Business

Comments:

Filed Under:

Posted by on March 2, 2005

Miguel Gomez Winebrenner, senior consultant, Cheskin

As a senior Hispanic market consultant with the innovation consulting firm Cheskin, Miguel Gomez Winebrenner works with companies to assess market opportunities, help design ways in which to enhance customer experience, and guide innovation in a way that is meaningful to consumers.

Originally from Colombia with an honors degree in Economics from the University of Iowa, Miguel worked for Yankelovich in Latin America and C&R Research in Chicago before joining Cheskin. His experience cuts across several verticals including financial services, consumer packaged goods, quick service restaurants, cable TV and telecommunications, entertainment, healthcare, and health and beauty aids.

Miguel is a member of the National Association for Multiethnicity in Communications (NAMIC) and the Cable and Telecommunications Association for Marketing (CTAM). He is immediate past president and on the Board of Directors of NAMIC South Florida, and is a member of the NAMIC National Multicultural Committee. He is a frequent contributor to business and trade publications and wrote the chapters on “Qualitative and Quantitative Research Strategies†and “Segmentation by Level of Acculturation†in the Hispanic Marketing and Public Relations book.

Comments:

Filed Under: